When businesses are selecting the most appropriate mode of accessing renewable energy the Virtual PPAs & Physical PPAs issue will come up. It shall also be noted that each of them has its strengths and weaknesses. However, in the case of CFE which is a utility giant and famous for delivering clean energy to consumers, how does it look like for the firms who want to indulge in a sustainable option?

Perhaps now it is high time that we analyzed all the advantages and disadvantages and all that the experts have to say.

What’s a Physical PPA?

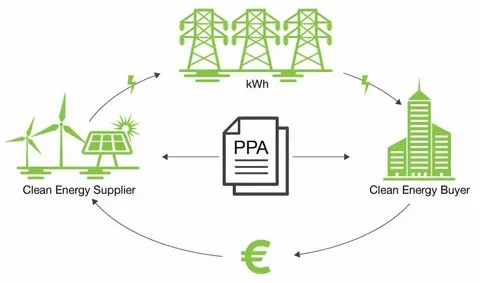

In a Physical PPA, the purchasing company takes the responsibility to purchase a dedicated amount of electricity from a renewable energy project. This electricity is physically transferred over the grid to the company’s location. In effect, the company gets the power, either utilizes it locally or returns it into the market depending on energy demand.

The main point here? Direct delivery makes it easier for a business to directly enjoy the renewable energy it purchases. But, there’s a catch. The company has to be situated in the same grid as the renewable energy project, which is not always convenient.

The Appeal of a Virtual PPA

In contrast, a Virtual PPA essentially does not entail the forwarding of energy physically and typically the exchange takes place virtually. Instead, the company pays money to buy a financial contract with the electricity generator while the physical electricity could be delivered elsewhere. This makes the Virtual PPA a more flexible option because companies can enter into PPAs with projects that could be located a long distance from the company’s premises or even in a different country.

For many businesses this is the ideal situation especially if they are into a manufacturing line of business. The financial risk management that Virtual PPA provides include helping firms hedge their bets against future energy prices since besides avoiding the risks associated with energy price volatility the Virtual PPA also supports clean energy projects. Moreover, they are also positioned to also claim the environmental benefits of the renewable energy certificates (RECs) even when the physical electricity is not being delivered.

Which One Is Better for Your Business?

So, which is the better option—Virtual PPA vs. Physical PPA? Experts agree that if you’re looking for flexibility and a chance to support renewable energy from projects that might not be geographically close; the Virtual PPA is a great choice.

For businesses with more specific energy needs, such as those requiring reliable, locally sourced power, a Physical PPA might make more sense. Additionally, Physical PPAs often offer a more straightforward accounting process, as they don’t fall under the same financial derivative rules that apply to Virtual PPAs.

The Bottom Line

At the end of the day, both CFE’s Virtual PPA vs Physical PPA offer sustainable solutions. The right choice comes down to what fits your company’s goals—whether it’s maximizing financial flexibility, managing energy costs, or claiming those eco-friendly credentials. Understanding both options thoroughly will help you make a well-informed decision.

Need a deeper dive into these energy contracts? Don’t hesitate to reach out to experts who can guide you through the ins and outs of CFE contracts and help you navigate the world of Virtual PPAs vs. Physical PPAs.